Leave aside how technology has transformed human lives, now they’re on the verge of revolutionizing the entire financial ecosystem too. Recent innovations in world of technology have compelled banking institutions to explore ways to adopt unlimited possibilities they could offer. The article explains nine trending technologies in Banking that will transform the industry in 2019 in a big way.

Table of Contents

9 Trending Technologies in Banking System

Over the years, these digital technologies changed the way banks addressed their customers’ fast-changing demands, and the trend will for sure going to continue. The article brings in brief trending technologies in Banking that are making banking systems quick, responsive and smart.

1. Biometrics

Biometrics simply replaced the traditional practices of passwords and OTPs for payments. Even payment service legend Mastercard is set to launch a new contactless card with an embedded fingerprint sensor for more secure transaction method.

Ace banker HSBC adapted biometrics to beef up security after recent cyber attacks. Now the bank is seriously mulling over enhancing security procedures with voice and touch recognition security services in the UK. Reports suggest that the new system will help banks to replace the need of passwords and memorable questions.

Use of Biometrics in Banking:

To recap, Barclays also beefed up its security mechanism in 2014 by offering fingervein scanning for authentication of large transactions.

2. In-car Apps

Another innovative digital technology that banking industry added into its kitty was in-car apps. Spain’s renowned banking conglomerate CaixaBank has created in-car mobile app that users can access while driving. The app was made using voice control functionality. The app integrates Ford’s SYNC with AppLink system to let drivers check their account balance, transfer funds and locate nearby branches and ATMs.

3. Smartwatches

As Smartwatches are getting popular by each passing day, it’s no surprise that it would intrude the banking sector one day. We are already looking at Apple’s smartwatch launch and its possible role in simplifying banking. Notably, the UK’s largest building society, Nationwide – have come up with apps to let customers manage accounts with a tap of their wrist.

4. Augmented reality

Very soon, augmented reality would be the part of banking systems. Last year, Australian bank Westpac launched an augmented reality app for mobile devices. It was a 3D imaging software that provided visualisations of balances and transaction history, as well as overlaying details over nearby Westpac branches.

Use of AR in Banking:

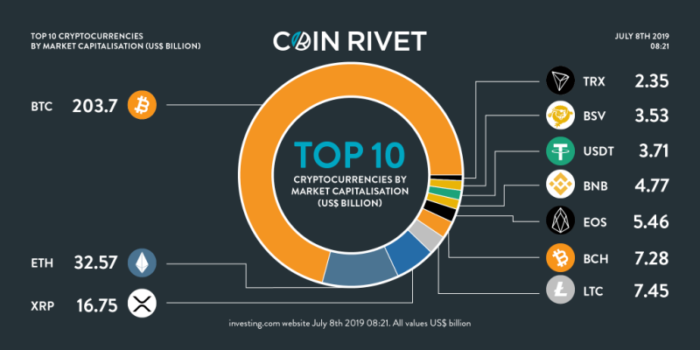

5. Cryptocurrencies

Though, most of us think Cryptocurrencies as threat to centralized banking system and afraid of its impact on major exchanges, we are sure that they have a major role to play. In 2014, German ‘Web 2.0’ lender Fidor proposed the first specialised bank for Cryptocurrencies.

Why Cryptocurreny is Helping Banking?

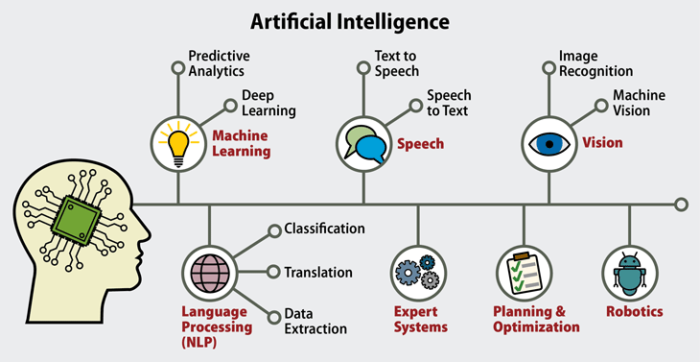

6. Artificial Intelligence

Now Banks are almost ready to leverage the hidden potential of artificial intelligence systems. In 20014, Swiss banking conglomerate signed a commercial agreement with software vendor Sqreem to put in place an AI based system which crunches huge volumes of information about a client’s behavior. It helped them have detailed, personalized information about the clients.

How Artificial Intelligence in Banking?

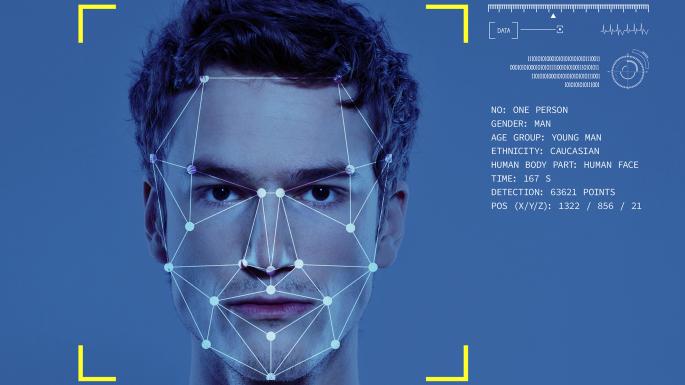

7. Facial Recognition

Facial recognition may have the potential to bring the payment processes one step further. Besides multiple authentication methods are available for banks and payment, the giants like Alibaba believes that even smiles could authenticate a payment. To recall, Alibaba launched a facial recognition system – dubbed ‘Smile to Pay’ this year that may be available as part of its Alipay platform in future.

Use of Facial Recognition in Banking:

8. Google Glass

In the list of digital innovations that banks will be adopting, Google glass is the next. It’s been reported that Spain’s Caixa Bank has already developed a mobile app based on Google Glass. The app works by superimposing directions to the nearest branch onto the Glass screen to fetch information such distance and phone number of the nearest branch. All this information is accessed through the voice recognition system.

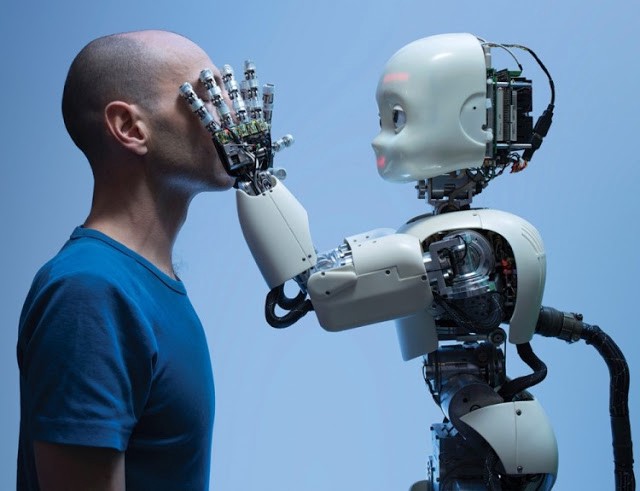

9. Robotics

Don’t think that robots are the talk of the future. They are very much in the industry now. If you take the example of branch service automation, Japan’s Bank of Tokyo Mitsubishi UFJ has used robots to serve customers of some of its bank branches.

Use of Robotics in Banking:

Moreover, NAO, the humanoid robot, created by French robotics company Aldebaran Robotics are easily answers basic customer service questions in 19 languages.

Trending Technologies in Banking : Conclusion

That’s all with the list of top 9 trending technologies in Banking system in 2019. If you think that the list is missing a few popular technologies, do tell us in comment box. Thank you for stopping by.

- Mavis Beacon Teaches Typing Software- All You Need to Know - July 3, 2024

- 10 Best Sites and Apps for Hindi to English Translation - June 29, 2024

- Which is Better Streamlabs or OBS? - March 11, 2024