Zelle is a Peer-to-peer money transfer software. Zelle streamlines the purchasing process and makes it simpler to move cash without using cash or going to the bank. It comes as a standalone mobile app that users can download and use on their smartphones.

Zelle’s service is also integrated into the mobile banking applications of the majority of the participating banks. Consumers who already have the mobile application of banks integrated with Zelle can start using the Zelle app immediately. Due to the wide usage of online payments, Zelle scams are hard to escape.

Table of Contents

How Zelle Works for Money Transfers?

Zelle is a digital payment service that allows you to send and receive money quickly and securely. Here’s how it works:

- Enroll: To use Zelle, you need to enroll with a participating bank or credit union. Most major banks offer Zelle as part of their online and mobile banking services.

- Link your account: Once enrolled, you’ll need to link your bank account or debit card to your Zelle profile. This step verifies your ownership of the account and allows you to send and receive money through Zelle.

- Choose a recipient: To send money, you need to know the recipient’s email address or mobile phone number. Make sure the person you’re sending money to is also enrolled with Zelle.

- Initiate the transfer: Using your bank’s mobile app or online banking platform, select the option to send money through Zelle. Enter the recipient’s email address or phone number, the amount you want to send, and any additional details requested.

- Confirmation and notification: After confirming the transaction details, your bank will initiate the transfer. The recipient will receive a notification via email or text message, informing them that you have sent them money.

- Recipient acceptance: The recipient needs to accept the money by following the instructions provided in the notification. If they are already enrolled with Zelle, the funds will be deposited directly into their linked bank account.

- Transaction completion: Once the recipient accepts the money, the transfer is completed. The funds are typically available in the recipient’s bank account within minutes, providing fast access to the money.

Similar read: What Is OnlyFans

What is Zelle Scams?

A Zelle scam is a fraudulent activity that involves using the Zelle payment platform to trick individuals into sending money to a fake account. Scammers often pose as trusted entities, such as friends, family members, or well-known companies, to convince victims to send money.

It is important to verify the recipient’s identity and account information before sending a payment through Zelle or any other financial platform to prevent becoming a victim of fraud.

The majority of reported Zelle scams are pure social engineering, which involves tricking people with false information and intimidation techniques. To trick people into approving money transfers without realizing it, con artists make up stories and representations. New zelle business account scams are always coming up.

In a typical scam, the scammer asks a user to confirm a large, fake Zelle payment in an email or text message. The fraudster then calls the customer back while posing as the bank and using a fake number from the financial institution after the user says they didn’t authorize the transfer.

Another common scam begins with a message warning that your bank account has been compromised and that you must act right away to fix the issue. Following up on your response, the scammers call you pretending to be your bank and walk you through the money transfer process.

Scammers may appear as entities other than your bank, like utility providers. For example, they make calls to threaten to cut electricity in homes and demand Zelle payments.

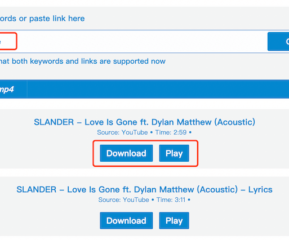

Similar read: What Is Genyoutube & How To Download Youtube Videos

Types of Zelle Scams:

There are several types of Zelle scams, including:

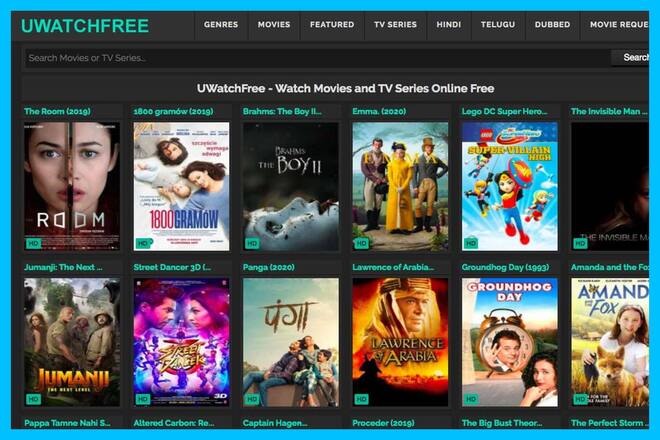

1. Fake Zelle websites and apps

Some scammers create fake websites and apps that look like Zelle, trying to trick people into thinking they’re using the real service. These fake sites and apps are made to look just like the official Zelle platform.

But if users enter their login details, personal information, or payment details on these fake platforms, scammers can use that information to get into their Zelle accounts.

This can lead to losing money and having their personal information stolen. It’s important to be cautious and make sure you’re using the official Zelle website or app to stay safe.

2. Phishing emails and text messages

Sometimes scammers send fake emails or text messages pretending to be from Zelle or a trusted bank. These messages try to make you believe that there’s something urgent happening with your Zelle account or the payment you made. They might even use official logos and email addresses to seem real.

In the message, they’ll ask you to click on a link or provide personal information like your Zelle login details, account numbers, or social security numbers. But if you do that, you’re actually giving the scammers access to your Zelle account.

They can then steal your money or use your personal information for identity theft. It’s important to be careful and not share your personal details unless you’re sure the message is from a legitimate source.

3. Social engineering scams

Sometimes scammers use tricks to manipulate people and get into their Zelle accounts. They might pretend to be someone the victim knows, like a friend, family member, or even a Zelle customer support representative.

They can contact victims through phone calls, emails, or social media and tell convincing stories to gain their trust. Once they’ve gained the victim’s trust, they ask for money to be sent through Zelle, often claiming it’s for an emergency or something important.

The victims, thinking they’re helping someone they know or dealing with a real situation, end up sending money directly to the scammers without realizing it. It’s important to be cautious and verify the identity of anyone requesting money through Zelle to avoid falling victim to these scams.

4. Zelle refund scams

In Zelle refund scams, scammers pretend to be sellers or service providers who owe the victim a refund for something they bought or paid for. They reach out to the victim through online marketplaces, classified ads, or social media and promise to send the refund using Zelle.

To make the refund happen, the scammers ask the victim to share their Zelle account details, like their email address or phone number linked to Zelle. But instead of giving a refund, the scammers use the victim’s Zelle information to make unauthorized transactions, causing the victim to lose money.

It’s important to be cautious when sharing your Zelle account details and double-check the authenticity of refund requests to avoid falling for these scams.

5. Overpayment scams

Scammers focus on people who sell things or offer services online. They pretend to be interested buyers and make an offer to pay more money than what was agreed upon. Once the seller agrees, the scammer sends a payment using Zelle.

But here’s the trick: the initial payment is usually fake, made with stolen credit card information or compromised bank accounts. Then, the scammer asks the seller to send back the extra money through Zelle, saying it was a mistake or for some other reason. The seller, thinking they’re just returning the overpayment, sends the money back using Zelle.

Unfortunately, they later realize that the initial payment was a scam, and they end up losing money. It’s important to be cautious and double-check payments before returning any extra funds to avoid falling victim to this kind of scam.

6. Employment scams involving Zelle

Scammers put up fake job ads on the internet or contact people directly, offering them job opportunities. They might say they’re hiring for remote positions where employees receive their salaries through Zelle. People who are searching for jobs may willingly share their Zelle account details with scammers, thinking it’s part of the employment process.

However, the scammers use this information for fraudulent purposes. In some cases, the victims unknowingly become involved in illegal activities like money laundering. The scammers transfer funds from illegal sources into the victims’ Zelle accounts and then move the money elsewhere, making the victims unknowingly play a part in these illegal actions.

It’s important to be cautious and verify the legitimacy of job offers before sharing any personal or financial information.

Similar read: Flutterwave Scandal: What You Need to Know?

Warning Signs of Zelle Scams

Unsolicited requests

Be cautious if you receive unexpected requests for money transfers through Zelle from people you don’t know or have no prior business with. Scammers often initiate contact out of the blue.

Urgency and pressure

Scammers may create a sense of urgency, insisting on immediate action or claiming that there are consequences for not complying. They may pressure you to send money quickly without giving you enough time to think.

Requests for personal information

Be wary of any requests for personal information, such as your Zelle login credentials, bank account details, or social security number. Legitimate sources will not ask for sensitive information over phone calls, emails, or text messages.

Poor grammar and spelling

Many scam messages contain grammatical errors, typos, or awkward language usage. Be cautious if you notice frequent mistakes in communication.

Suspicious email addresses or URLs

Check the sender’s email address or the website URL for any discrepancies. Scammers often use email addresses or URLs that imitate legitimate sources but have slight variations or misspellings.

Unexpected prize winnings

Be skeptical if you receive notifications claiming you’ve won a lottery, sweepstakes, or contest that you didn’t enter. Scammers may use such tactics to lure victims into providing their Zelle information.

High-risk payment requests

Be cautious if someone asks you to use Zelle for high-risk transactions, such as buying or selling high-value items from unknown individuals. Scammers may take advantage of Zelle’s fast transaction speed to commit fraud.

Unsolicited remote access requests

Be wary of unsolicited requests to remotely access your computer or smartphone. Scammers may use this as an opportunity to gain control over your device and access sensitive information.

Too good-to-be-true offers

Exercise caution when encountering offers that seem too good to be true, such as extremely high-paying jobs or unrealistically low-priced products. Scammers often use attractive offers to lure victims into their traps.

Lack of official communication channels

Legitimate organizations, including Zelle and financial institutions, have official communication channels and customer support. If you cannot find official contact information or the communication is solely through unconventional channels, it may be a sign of a scam.

Similar read: What Is Backmarket?

Tips to protect yourself from Zelle Scams

Don’t respond to unsolicited texts and emails

This recommendation is valid for all alleged frauds, not only those involving Zelle. Don’t reply if you get a communication from your bank that claims to be from them, but you didn’t get in touch with them beforehand.

Instead, make direct phone contact with your financial institution to ask about your account and any potential security issues. You need to be careful on social media to not fall victim to Facebook marketplace Zelle scams that are prevalent.

You can also let your bank know that you’ve been phished, assuming there are no issues with your account. You could work with your bank to protect your account if you provided some personal information as a result of the phishing attempt.

Don’t share two-factor authentication

2FA also referred to as multifactor authentication or two-factor authentication, increases the security of your accounts. An additional one-time password that lasts for 30 to 60 seconds will be sent to you each time you sign into your account. It is often sent to you via email or text message.

Never share your one-time passcodes with anyone once 2FA has been enabled for your banking accounts. Criminals posing as your bank or utility provider may pressure you with numerous false reasons to reveal your passcode, but legitimate institutions will never do so.

Watch for urgent payment deadline scams.

Alarm bells need to start ringing if someone tells you that you must take quick action to fix a financial issue. Scare tactics and a sense of urgency are used by con artists to make you fear and less inclined to exercise critical thinking.

Users were given only 30 minutes to take action in the utility scams discussed in the section above before their power was cut off.

Be cautious of any requests for new Zelle payments from banks, companies, or utilities, especially if you’ve never used this app to pay them previously. Contact the business directly through their official website or phone number if you ever receive requests to pay with Zelle in order to learn more.

Steps to take after getting scammed

First, get in touch with the financial institution that was involved in the transaction as away. This makes it possible for the company to launch an investigation right away. You’ll need to respond swiftly due to Zelle’s immediate nature. Check that can zelle refund money if scammed in any way if you lost money.

Numerous local reports state that banks have been reluctant to compensate damages from Zelle phishing attacks because the transactions were actually authorized by the account users. Only when news stories about their schemes forced institutions to comply with several recent victims had their money refunded.

Similar read: What Is The Pinterest Creator Fund

Final thoughts

Knowing customer protection laws will help you. If a third party fraudulently persuades a customer to reveal account access information, that customer should be given the same safeguards as if the funds had been obtained through a stolen debit card or other banking access devices.

- What is Epic Games Launcher and How to Install It? - July 15, 2024

- What Is Audius Music Streaming App and How Does it Work? - July 13, 2024

- The 10 Best Astronomy Apps for Stargazing - July 12, 2024