Being a student in this millennium is easier in many ways than in the past, thanks to the plethora of available online tools and finance apps, but financially, it is a bigger burden than ever. Americans owe over $1.45 trillion, and the average college graduate in 2016 had a 6% higher debt than graduates from the year before.

Luckily, there are best finance apps for students for that; top apps won’t exactly pay off your loan, but they will make sorting your finances a whole lot easier. In this post, we highlight the importance of financial management and suggest a list of apps you can’t live without.

Table of Contents

Why is Financial Management Important?

Debt is something most of us have to live with for a great part of our adult years. From the time we are students and we don’t have a home or additional financial responsibilities, it is important to be very well aware of issues like interest rates, credit, and options for reducing debt. Inertia and lack of information are the pillars on which financial disaster is based.

Never fear changing your financial situation through steps such as refinancing or debt consolidation. Planning will take time and research but will possibly take years off a big loan. Use these cool finance apps for students to start making a difference to your financial outlook:

1. ChangEd

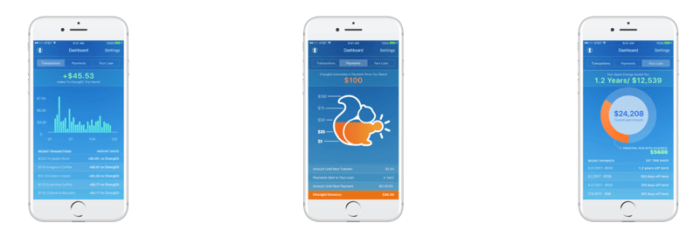

The developer of this app, Dan Stelmach, was very overwhelmed by his student debt when he started his career, and he decided that one way to do so, was by using spare change to pay off more of his debt every month.

ChangeEd sets aside your spare change, putting the latter towards your student loan payments automatically. It is this easy: say you buy a pizza for $9.25. This is the best personal finance app that will round up to $10 and put the remaining $0.75 towards your payment!

2. OnTrees (Discontinued)

Most of us can set a budget quite easily; sticking to it, however, can be a bit of a challenge. This app handles all income and outgoings in one handy place, and lets you know how closely you are sticking to your budget. It’s great for identifying what type of item you are spending too much on, and what necessities you may be ignoring.

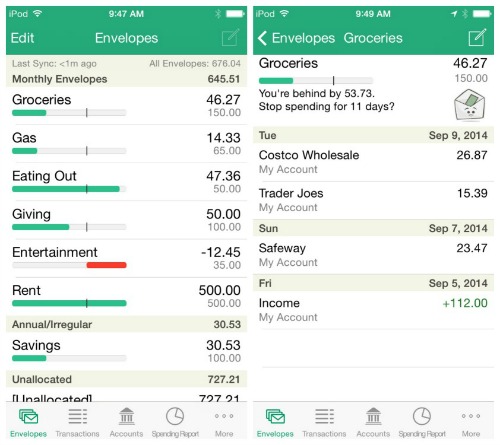

3. Goodbudget

This app takes the idea of ‘money envelopes’ to the virtual world, assigning a specific amount for each category you decide. Check which envelopes are empty and which are full; do you need to reallocate amounts in accordance with your needs?

This finance app can be used my multiple users, thanks to a syncing facility. The app is free, though premium users receive additional benefits such as an unlimited number of envelopes and a detailed transaction history.

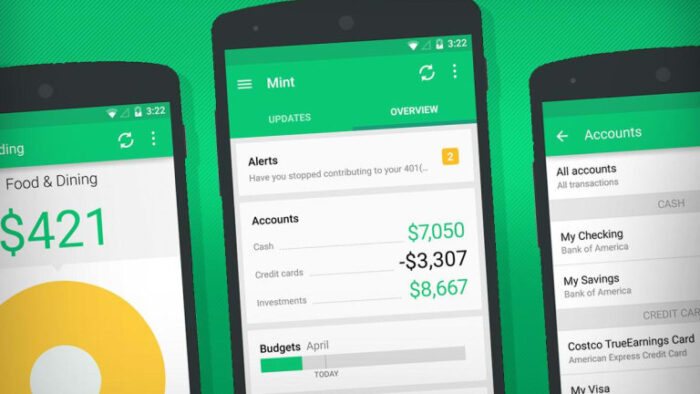

4. Mint

This cool app was created by the whizzes from TurboTax and Quicken. It helps you create a personalized budget, notifying you of any unusual charges and giving you helpful advice of how to reduce your spending. The app claims to offer “a more complete picture of your financial life,” providing you with everything from your credit score, to your net worth and account balances.

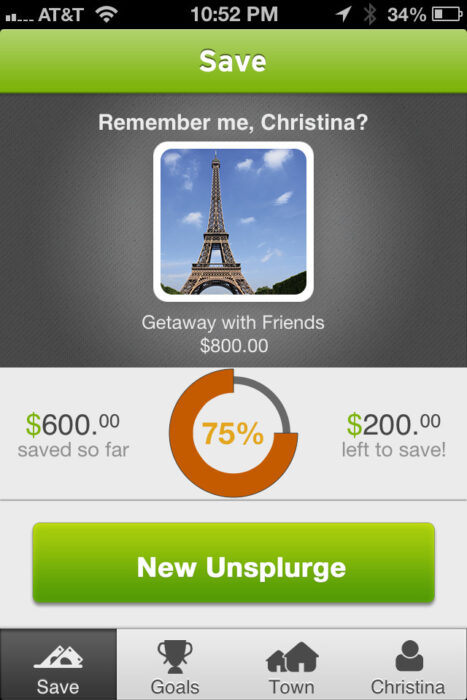

5. Unsplurge

Saving does not always have to go towards your loan. You need to treat yourself once in a while too, and this app will help you do so responsibly. The app has several functionalities like google finance app for students.

It has its own social network, which you can use to share your progress with the community, as well as with family and friends. Expect lots of cheerleading on the sidelines and be prepared to give some support as well.

6. Home Budget with Sync

This is an excellent app if you have a family or you share expenses with other students you share a flat with. It allows you to set a group budget (incorporating expenses such as utility bills, grocery shopping etc.), syncing income and expenses between everyone’s respective smartphones.

A handy chart shows what you are spending the most on and provides an itemized list of purchases. At the end of the month, you can obtain a crystal clear picture of items that you can forego next month, and identify areas of expenditure that need cutting down.

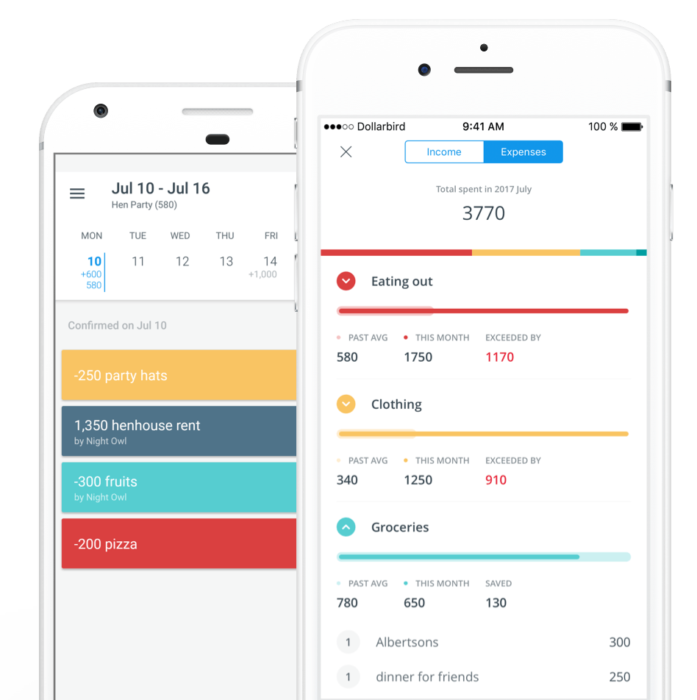

7. Dollarbird

This app is great for those who like to view their expenses in calendar-style mode. If you have ever used yahoo finance app, you will find this app quite similar. It is interesting to analyse patterns in expenditure and identify the days on which you spend the most money. This app can also be shared with family members or fellow students. Use it to create multiple budgeting calendars and manage finances together.

8. Spendee

How many times have you resolved to keep every single bill to study your spending patterns at the end of the month, only to inadvertently throw more than half away? Spendee has a similar design to Home Budget with Sync (in that it presents expenditure in percentages, in brightly colored charts), but one big bonus is that it gives you the option of taking photos of bills and receipts, so you don’t miss a single expense during budgeting tine.

This is the best personal finance app for college students goes the extra mile with a budgeting tool, which takes it beyond a mere expense tracker. For a small fee, you can create multiple budgets and sync data across various devices.

Student loans are a fact of life these days, with many colleges charging fees that parents or students cannot afford to pay. In order to ensure we are debt-free as soon as possible (so we can start enjoying the fruits of our hard work), budgeting from the time we are freshmen is key. Technology has stepped in big-time, with a host of finance apps that are fun, addictive, and immensely helpful.

- 11 Best Photo Scanning Apps for iOS and Android (Updated) - July 10, 2024

- Guide to Choosing the Best Spy Phone App in 2023 - April 20, 2023

- Playable Ads: Get All the Juice Out of Your Advertising Efforts - April 6, 2023