Mobile payment processing applications, often known as peer-to-peer applications, allow you to send money rapidly and effectively from one individual to another individual’s bank account.

These applications make payments easier and allow people to integrate their current bank accounts into a wallet app. With only a few clicks on a smartphone, you may complete digital money transfers.

Table of Contents

Best Money Transferring Apps in India 2021

These ten best money transfer apps have excellent reviews on app stores. They let app users send money securely, and have no hidden costs. Following is the list of the top ten best money transfer applications.

1. Paypal – Send and Request Money Fast

The app’s many features, along with its simplicity and efficiency, have placed it firmly in the top prize zone. PayPal’s brand identity elevates it to the top of the product in the world. The name and brand awareness that Paypal receives from the public are one of the benefits of having Paypal.

Payal Features:

The app’s UI is simple to use and provides a pleasant operating experience. The last benefit is that you will have a transaction application that is both speedy and secure. PayPal’s payment processing capabilities are versatile, safe, and simple to use, which sets it apart from the competition.

2. CashApp – Cash Rewards App

This software received the best rating throughout the low costs category since it allows customers to send money for nothing using a smartphone application. This app shines out because of the convenience which it offers, minimalism, and almost no charges.

Along with many other fund transaction apps, it provides more than simply transaction choices. The application’s user interface is simple and quick. It’s ideal for requesting money from colleagues and relatives. But if you have transferred money to some other person’s account, you’ll have to depend only on that person to repay it.

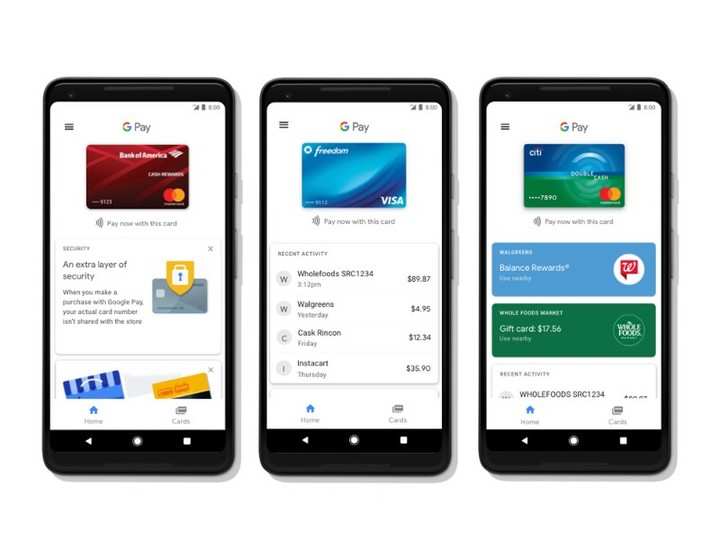

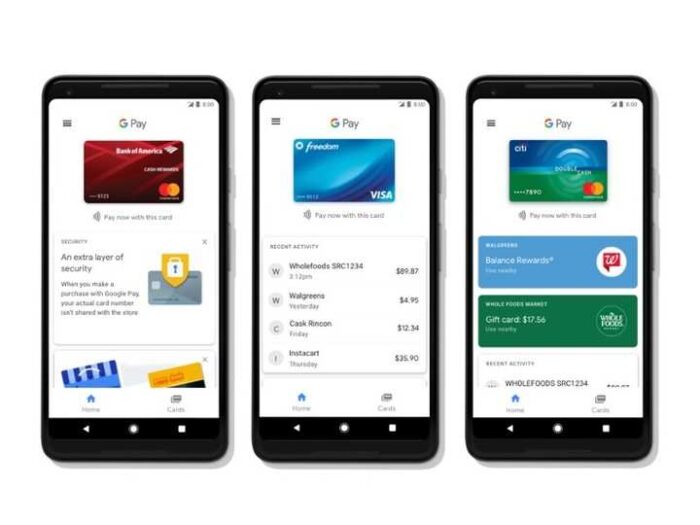

3. GooglePay – Secure UPI payment

The application, which is in actual a Google product, is among the best reliable money transaction applications. It’s extremely easy to sign-in on the app and is available for both Google Play and Apple App Stores.

Features:

Using Google Pay, one might send money to family, colleagues, and even those people who just aren’t there on one’s phone contacts. E-commerce activities, and also mobile recharges and paying all types of bills, all of the above can be done with this application. It also provides the best safety and encryption against fraudsters and cybercriminals.

4. Western Union – Send Money Transfers Quickly

This application is by far the most widely used money transaction provider in the world and also it serves a representation in over 200 countries around the world. This is a very well-established service that could be utilized to move funds quickly and easily.

It is indeed a simple software to set up and then use, with advantages like beginning a transfer with a fingerprint Sensor and reading a credit/debit card rather than inputting all of the card details. It allows for convenient transaction tracking with distinctive tracking information. The software may also be used to pay invoices for dozens of businesses.

5. Venmo

Venmo is an electronic payment software with interactive features geared for a younger demographic. It is indeed a youth-oriented app built with the latest application development techniques in consideration.

The app is proved to have been a simple and effective way to transfer funds. Venmo is exclusively available in the United States. It allows you to customize transactions by adding emojis, emoticons, or charming remarks.

Features:

There have been no extra charges if you transfer funds using a method except a connected credit card. The application’s cash could be used to pay for expenses.

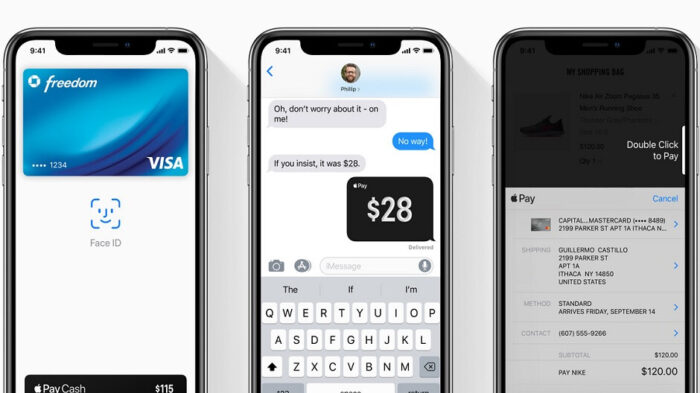

6. ApplePay

The application is a convenient and effective way to make transactions in devices, shops, and on the internet. It is sometimes used to pay a subscription to Apple News, as well as many other Apple programs, as well as upgrade iCloud storage.

Features:

One doesn’t need to register a profile or make appointments to purchase goods; everything you need will be your fingerprint Identity. The much more appealing characteristic of the app is the ability to send money through text messages without having to download software. The voice companion on an iPhone may be used to make payments.

7. Paytm – UPI, Money Transfer, Recharge

It is a prominent financial services firm that offers transaction, banking, eCommerce, and investing services. Mobile recharges, digital wallet operations, any type of bill payments, and theatre and transport ticket reservations are all available through Paytm.

Features:

Customers may also purchase, trade, and perform commercial transactions using the Paytm store. Paytm Wallet is a service that allows Paytm members to engage in money market instruments. It provides incredible rewards and savings. There seem to be no additional fees for transferring funds to the Paytm wallet or bank account.

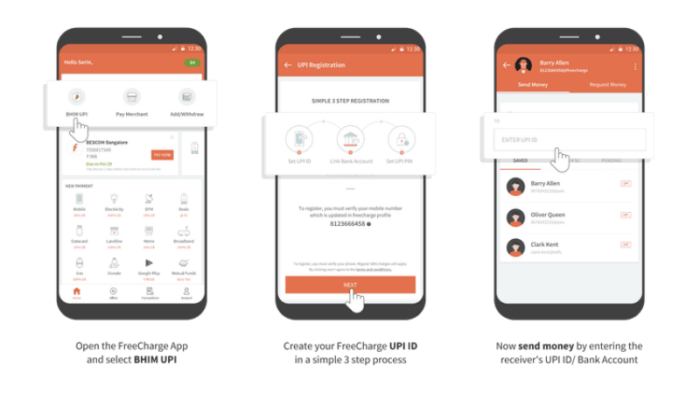

8. Freecharge Money Transfer App

Freecharge is a popular payment processing tool with a user-friendly design. Bill payments, reservations, purchases, and any type of recharges are all supported in addition to money transfers.

Features:

It enables UPI connectivity, making Bank transfer transactions straightforward. It is a trustworthy service because of its secure and secured operations. Freecharge is exclusively accessible in India. It offers many cash-backs and rewards to the users on making payments using the app.

9. AmazonPay – Money Transfer, Bill Payment

This app is an effort of the e-commerce company Amazon that seeks to improve customer service by enabling transactions simple and enjoyable. It could be utilized to transfer funds to family members and colleagues, recharge phones, paying the bills, and paying for deliveries with just one touch.

It provides complete consumer safety and top-notch security. It can also be used to make payments in EMIs. Its simple transactions and prompt reimbursements make it a good app to use. It provides limitless prizes and enticing deals.

10. SamsungPay

Samsung Pay has quickly become popular payment processing software for Apple users and Android users, despite its limited geo-availability in the United States. It saves credit card details, debit card information, and enables customers to instantly pay at any type of store using the app’s convenient features.

Features:

For example, consumers can adopt a contactless transaction method. It is compatible with thousands of credit unions and banks. The app assists customers in discovering great local offers. It also has capabilities that allow customers to pay any type of merchant instantly.

- AI’s Impact on Personalization, Analytics, and Retention in Gaming - April 12, 2024

- The Marketer’s Marathon: Long-Distance Strategies for Sustained Traffic Growth - March 29, 2024

- What Is MagSafe for iPhone? A Quick Guide - March 18, 2024